There’s a definitive process that individuals need to understand when plunging into rental property mortgages in Iowa. From the intricacies of loan types available to the crucial factors that can affect approval, navigating this financial landscape requires careful consideration and knowledge. Understanding the interest rates, loan terms, and down payments associated with rental property mortgages can make a significant difference in one’s investment success. Let’s explore the important aspects of how rental property mortgages operate in Iowa.

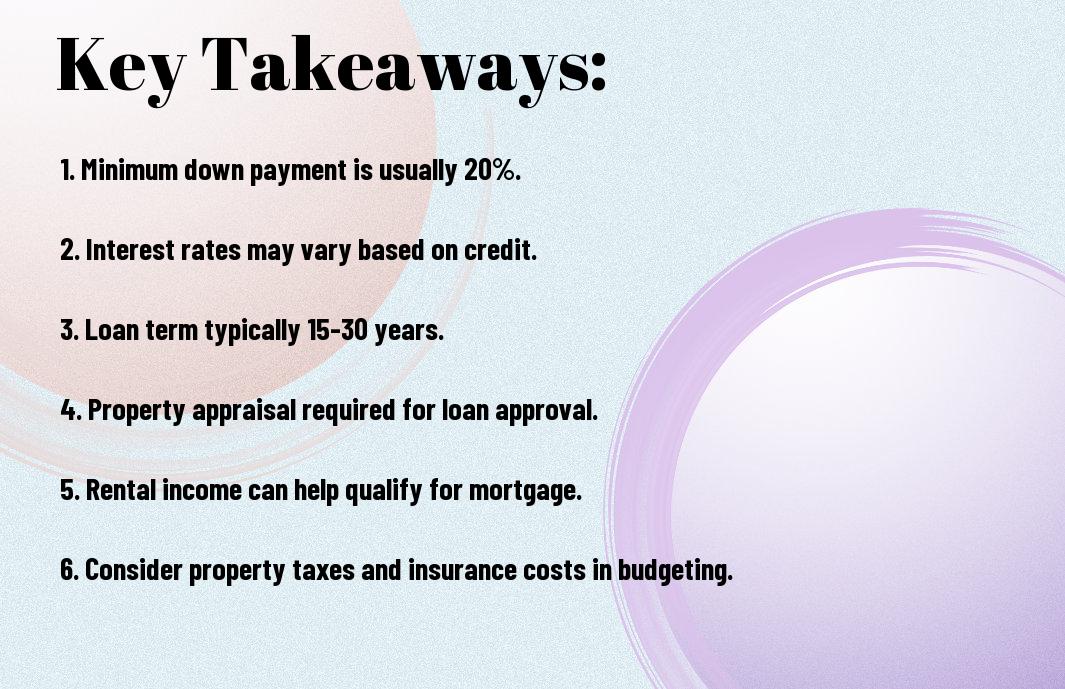

Key Takeaways:

- Down payments: Iowa rental property mortgages typically require a larger down payment compared to owner-occupied mortgages, often ranging from 15% to 25% of the property’s purchase price.

- Interest rates: Interest rates for rental property mortgages in Iowa may be slightly higher than those for primary residences, as lenders view rental properties as higher risk investments.

- Rental income: Lenders may consider a portion of the rental income when evaluating a borrower’s ability to repay the mortgage, which can help offset the costs of owning a rental property.

Understanding the Iowa Rental Property Mortgage Landscape

Types of Rental Property Mortgages Available in Iowa

Clearly, when it comes to financing a rental property in Iowa, investors have several options available for obtaining a mortgage. From traditional fixed-rate mortgages to adjustable-rate mortgages, each type has its own set of advantages and considerations. Understanding the features of each type is crucial in making an informed decision. The Iowa rental property mortgage market offers a variety of mortgage products to cater to different investor needs and financial situations.

| Mortgage Type | Description |

| Fixed-Rate Mortgage | A mortgage with a locked interest rate for the entire loan term. |

| Adjustable-Rate Mortgage | A mortgage with an interest rate that may change periodically. |

| Portfolio Loan | A loan kept in the lender’s investment portfolio rather than being sold on the secondary market. |

| FHA Loan | A government-backed loan that offers low down payment options. |

| VA Loan | A loan guaranteed by the Department of Veterans Affairs for eligible veterans and active-duty personnel. |

Key Factors Affecting Mortgage Conditions in Iowa

Conditions on rental property mortgages in Iowa can be influenced by various factors. Knowing these key factors can help investors navigate the mortgage market more effectively. Understanding how factors such as credit score, loan-to-value ratio, property type, and rental income potential impact mortgage conditions is crucial for securing favorable terms.

- Credit Score: A higher credit score can lead to better mortgage terms.

- Loan-to-Value Ratio: The ratio between the loan amount and the property’s value affects the interest rate.

- Property Type: Different property types may have varying mortgage requirements.

- Rental Income Potential: Lenders may consider the property’s rental income when determining mortgage conditions.

Applying for a Rental Property Mortgage

Eligibility Criteria for Rental Property Mortgages in Iowa

Eligibility for a rental property mortgage in Iowa is based on several factors. Lenders typically look at your credit score, debt-to-income ratio, rental property cash flow, and your ability to make a down payment. It is vital to have a good credit score, usually above 620, and a stable income to qualify for a rental property mortgage.

Required Documentation and Application Process

Process for obtaining a rental property mortgage in Iowa requires specific documentation. You will need to provide proof of income, tax returns, rental property financials, and possibly a business plan. The application process includes completing a loan application, meeting with a lender, and undergoing a thorough financial background check.

Mortgage lenders in Iowa will carefully examine your financials, credit history, and business plan before granting you a rental property mortgage. It is crucial to have all the necessary documentation ready and to present yourself as a reliable and responsible borrower. Meeting the eligibility criteria and providing accurate information will increase your chances of securing a rental property mortgage in Iowa.

Financial Considerations of Iowa Rental Property Mortgages

Interest Rates and Fees

All prospective landlords in Iowa need to consider the interest rates and fees associated with rental property mortgages. Interest rates can vary based on many factors, including credit score, loan term, and down payment amount. Additionally, there are various fees such as origination fees, appraisal fees, and closing costs that need to be factored into the overall cost of the mortgage.

Tax Implications of Rental Property Ownership in Iowa

Interest deduction is a significant advantage of owning rental property in Iowa. Landlords can deduct interest paid on their mortgage from their taxable income, reducing the overall tax burden. However, it’s imperative for landlords to understand the tax implications of rental property ownership in Iowa fully. Rental income is subject to state and federal taxes, and landlords may also be eligible for deductions on expenses related to the property.

Property owners should keep detailed records of all income and expenses related to their rental property to ensure accurate reporting and maximum tax benefits. It’s recommended to consult with a tax professional to navigate the complexities of rental property tax laws in Iowa.

Managing Your Iowa Rental Property Mortgage

Refinancing Options

Keep in mind that refinancing your Iowa rental property mortgage can be a strategic move to lower your interest rate, reduce monthly payments, or access equity in your property. An necessary aspect to consider is the current market conditions and your financial goals when exploring refinancing options.

Repayment Strategies and Tips

Options for managing your Iowa rental property mortgage include making extra payments, setting up bi-weekly payments, or refinancing to shorten the loan term. Your repayment strategy should align with your financial situation and long-term goals. The key is to stay disciplined with your payments to build equity and pay off the loan faster.

- Extra payments: Making additional payments towards the principal can help reduce the total interest paid over the life of the loan.

- Bi-weekly payments: Splitting your monthly payment into bi-weekly installments can help you make an extra payment each year, accelerating the payoff schedule.

- Refinancing: Consider refinancing to a shorter loan term to save on interest costs and pay off the loan sooner.

Your repayment strategy plays a crucial role in the financial health of your rental property. The key is to explore different options and choose the one that best fits your financial goals while staying committed to your repayment plan.

Conclusion

To wrap up, rental property mortgages in Iowa work similarly to mortgages for primary residences. Investors can secure loans to purchase rental properties, with the property itself serving as collateral. Interest rates, loan terms, and down payment requirements may vary based on the lender and the investor’s financial situation. It’s crucial for investors to thoroughly research and compare different mortgage options to find the best fit for their investment goals in Iowa.

FAQ

Q: What is a rental property mortgage?

A: A rental property mortgage is a type of loan specifically designed for purchasing a property that you plan to rent out to tenants. It typically has different requirements and terms compared to a mortgage for a primary residence.

Q: How do rental property mortgages work in Iowa?

A: In Iowa, obtaining a rental property mortgage follows a similar process to getting a traditional mortgage. You will need to meet certain criteria such as having a good credit score, a low debt-to-income ratio, and a down payment of typically 20-25% of the property’s purchase price. Lenders will also assess the property’s rental income potential to determine the loan amount.

Q: What are the differences between a rental property mortgage and a primary residence mortgage in Iowa?

A: Rental property mortgages in Iowa often have higher interest rates and require larger down payments compared to primary residence mortgages. Lenders may also consider the property’s rental income in addition to your personal income when determining eligibility for a rental property mortgage.