Looking to buy a home but don’t have traditional pay stubs or tax returns to prove your income? You may still have options. While unconventional, some lenders offer stated income loans or bank statement loans which allow borrowers to secure a mortgage without traditional income documentation. However, these loans often come with higher interest rates and stricter requirements to mitigate the higher risk for the lender. It’s imperative to fully understand the terms and potential risks associated with these types of mortgages before committing to one.

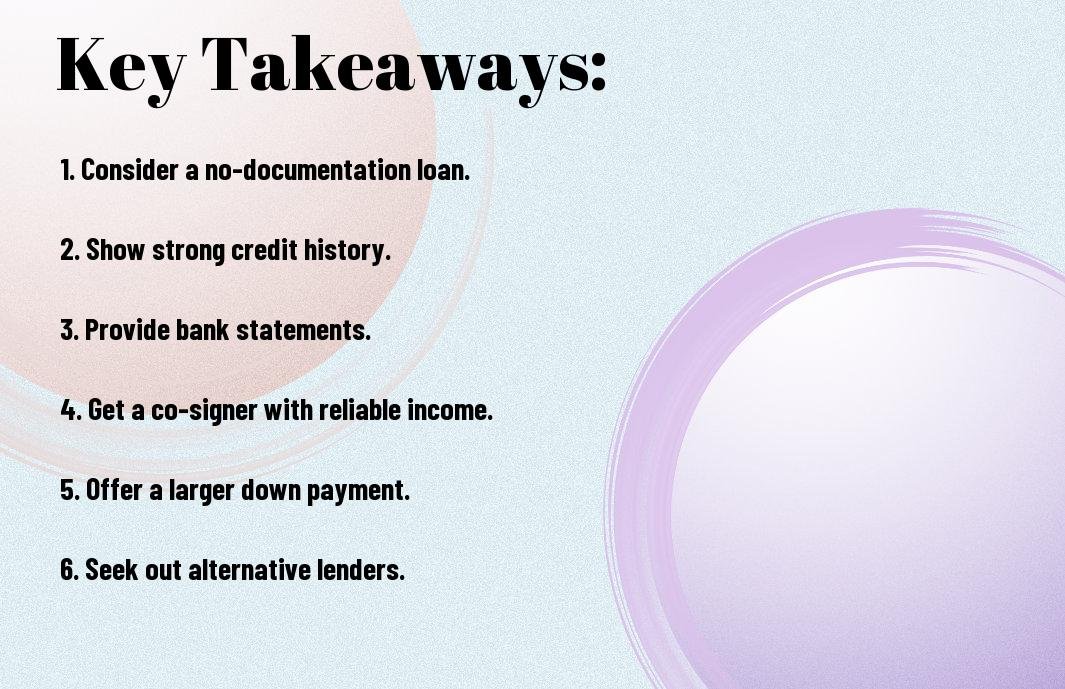

Key Takeaways:

- Consider alternative documentation: When applying for a mortgage without documented income, you can explore alternative forms of verification such as bank statements, assets, or proof of business ownership.

- Look for specialized lenders: Some lenders cater to individuals who may not have traditional income documentation. Research and find lenders who offer programs tailored for self-employed individuals or those with non-traditional income sources.

- Improve credit score and provide a larger down payment: To increase your chances of approval, work on improving your credit score and consider putting down a larger down payment. This can help offset the risk for the lender and potentially make you a more attractive borrower.

The Basics of Mortgage Qualification

Importance of Documented Income

The first step in qualifying for a mortgage is proving your ability to repay the loan. Lenders typically require documented income to assess your financial stability and ensure that you can afford the monthly payments. Without proof of income, it can be challenging to secure a mortgage as it is a key factor in determining your eligibility.

The Role of Credit History and Credit Score

Income is crucial, but your credit history and credit score also play a significant role in mortgage qualification. Lenders use this information to evaluate your creditworthiness and assess the risk of lending to you. A strong credit history and high credit score can improve your chances of qualifying for a mortgage, while a poor credit history or low credit score can make it more difficult to secure financing.

Plus, a low credit score may result in higher interest rates, making the loan more expensive over time. It is important to maintain a positive credit history by making timely payments and keeping your credit utilization low to increase your chances of qualifying for a mortgage without documented income.

Alternative Mortgage Options

Stated Income Loans

Your search for a mortgage without documented income may lead you to explore stated income loans. These types of loans allow borrowers to state their income without having to provide traditional documentation such as tax returns or pay stubs. Lenders will typically verify the borrower’s employment and may require bank statements to support the stated income. Keep in mind that interest rates on stated income loans can be higher than traditional mortgages, and down payment requirements may also be more stringent.

No-Doc and Low-Doc Loans

Any borrower looking for alternative mortgage options may consider no-doc and low-doc loans. These loans require little to no documentation of income, assets, or employment. While these loans offer flexibility and speed in the application process, they come with greater risk for lenders and borrowers alike. No-doc loans do not require any income verification, while low-doc loans may ask for minimal documentation such as bank statements or asset verification.

For instance, the lack of income verification in these loans can lead to higher interest rates and potentially put borrowers at greater risk of default. It is vital for borrowers considering these options to carefully weigh the risks and benefits before proceeding.

Preparing for a Non-Traditional Mortgage Application

Building a Strong Financial Profile

Many lenders offering non-traditional mortgages look for borrowers with a strong financial profile. This includes a good credit score, enough savings for a down payment, and a history of responsible financial behavior. It’s imperative to demonstrate your ability to manage your finances effectively to increase your chances of approval.

Gathering Alternative Documentation

Financial institutions may require alternative documentation to verify your income when applying for a mortgage without documented income. This can include bank statements, investment accounts, and proof of other assets. NonTraditional It’s crucial to gather as much documentation as possible to support your application and show lenders that you are a low-risk borrower.

Understanding your options and being prepared with the necessary documentation can significantly improve your chances of getting approved for a mortgage without documented income. By building a strong financial profile and gathering alternative documentation, you will demonstrate to lenders that you are a trustworthy borrower capable of managing a mortgage responsibly.

Strategies for Success

Shopping for the Right Lender

For individuals seeking a mortgage without documented income, shopping for the right lender is crucial. Look for lenders who specialize in alternative income verification or asset-based loans. These lenders are more likely to understand your situation and offer suitable options.

Tips for Navigating the Application Process

For those navigating the application process without documented income, there are several tips to keep in mind. The key is to be prepared with all necessary documentation, such as bank statements, investment accounts, and other assets. Transparent communication with the lender about your financial situation is also imperative, along with demonstrating stability through a good credit score and a solid employment history.

- Be organized and gather all relevant financial documentation.

- Communicate clearly with the lender about your financial situation.

- Demonstrate financial stability with a good credit score and employment history.

Right approach to the application process can increase your chances of securing a mortgage without documented income.

Conclusion

With this in mind, obtaining a mortgage without documented income can be challenging but not impossible. By diligently preparing a strong application package that includes proof of assets, a good credit score, and a solid payment history, you can increase your chances of getting approved for a mortgage. It is also crucial to work with a lender who specializes in alternative income verification methods, such as bank statement programs or asset depletion loans. By taking these steps and demonstrating your financial stability, you can still achieve your goal of homeownership even without traditional sources of income documentation.

FAQ

Q: Can I get a mortgage without documented income?

A: Yes, you can still get a mortgage without documented income through alternative income verification methods. Lenders offer options such as bank statements, asset-based income, or using a co-signer to qualify for a mortgage without traditional income verification.

Q: What are some alternative income verification methods for obtaining a mortgage without documented income?

A: Some alternative income verification methods include providing several months of bank statements to show consistent deposits, using assets such as savings, investments, or retirement accounts to demonstrate the ability to repay the mortgage, or having a co-signer with documented income to support the loan application.

Q: Are there specific mortgage programs available for individuals without documented income?

A: Yes, there are specialized mortgage programs designed for individuals without documented income, such as bank statement loans, asset depletion loans, or non-qualified mortgage (non-QM) programs that cater to borrowers who may have difficulty providing traditional income documentation.